Would the Company Want Derrick to Pursue This Investment Opportunity

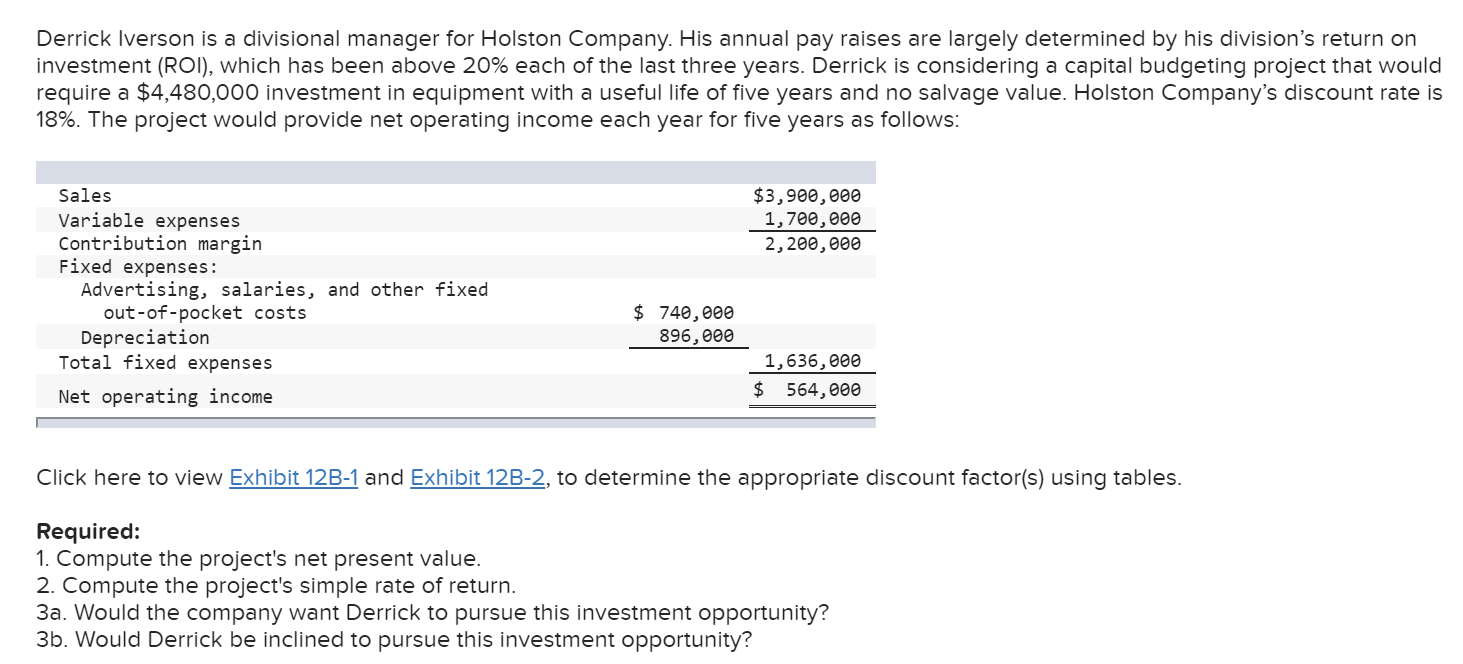

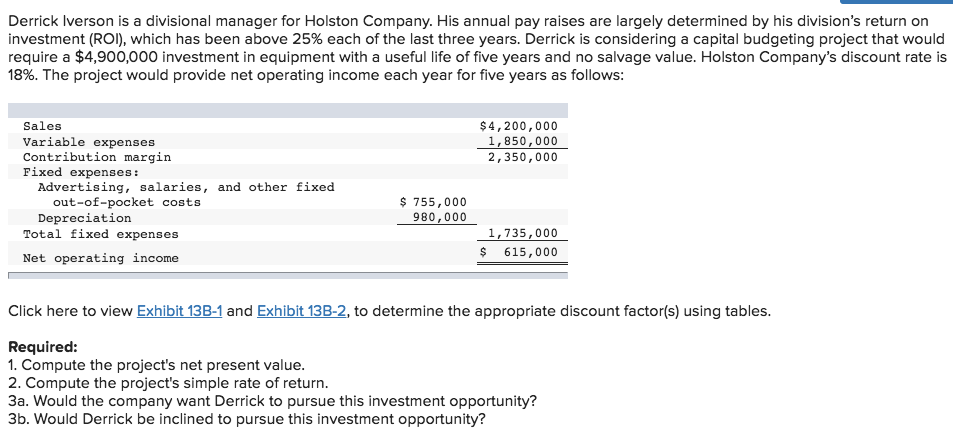

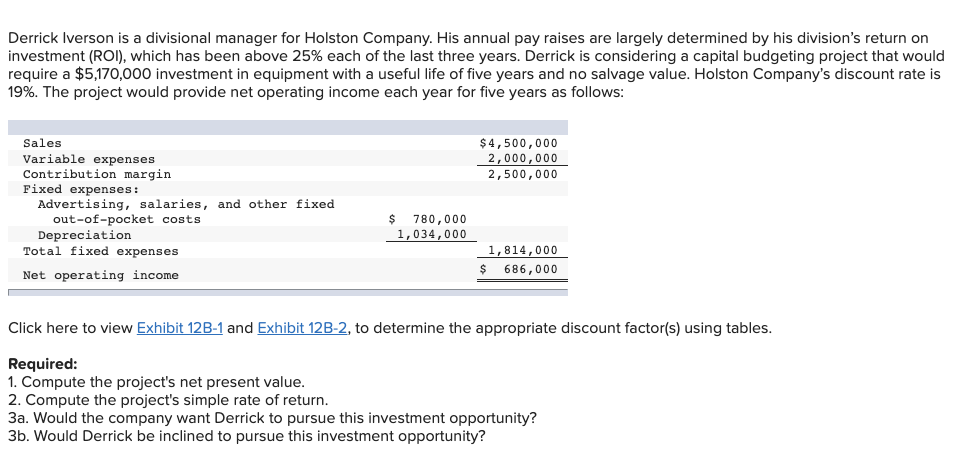

The project would provide net operating income each year for five years as follows. Would the company want Derrick to pursue this investment opportunity.

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

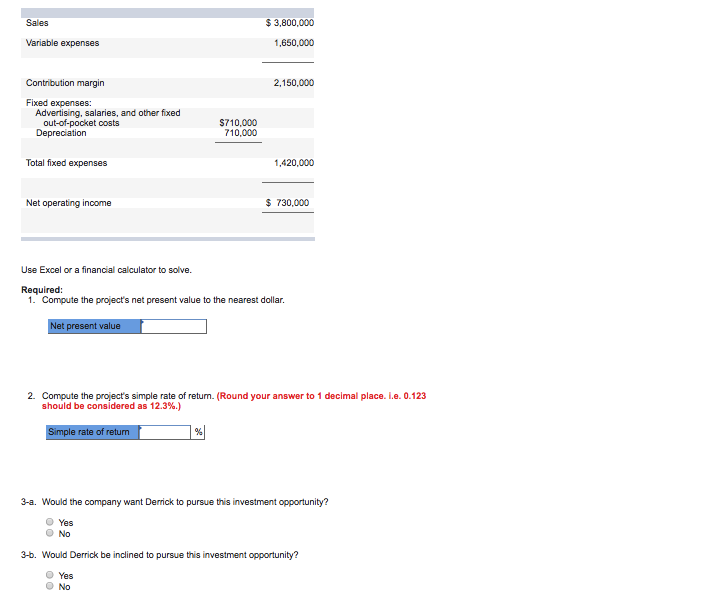

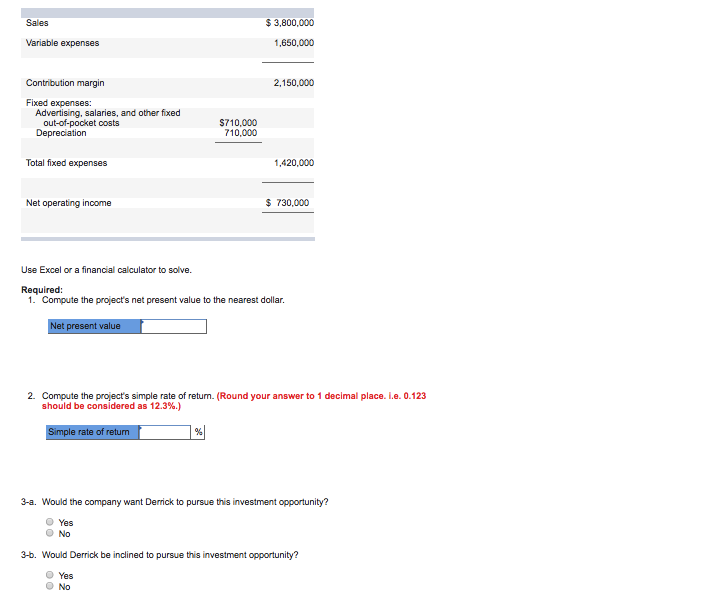

The company would want Derrick to pursue the investment opportunity because it has a positive net present value of 16800.

. Course Title FINANCE MISC. Holston Companys discount rate is 15. The CEO would not pursue the investment opportunity because it lowers her ROI from 32 to 309.

Answer to 3-a. Computation of the annual cash inflow associated with the new electronic games. Would Derrick be inclined to pursue this investment opportunity.

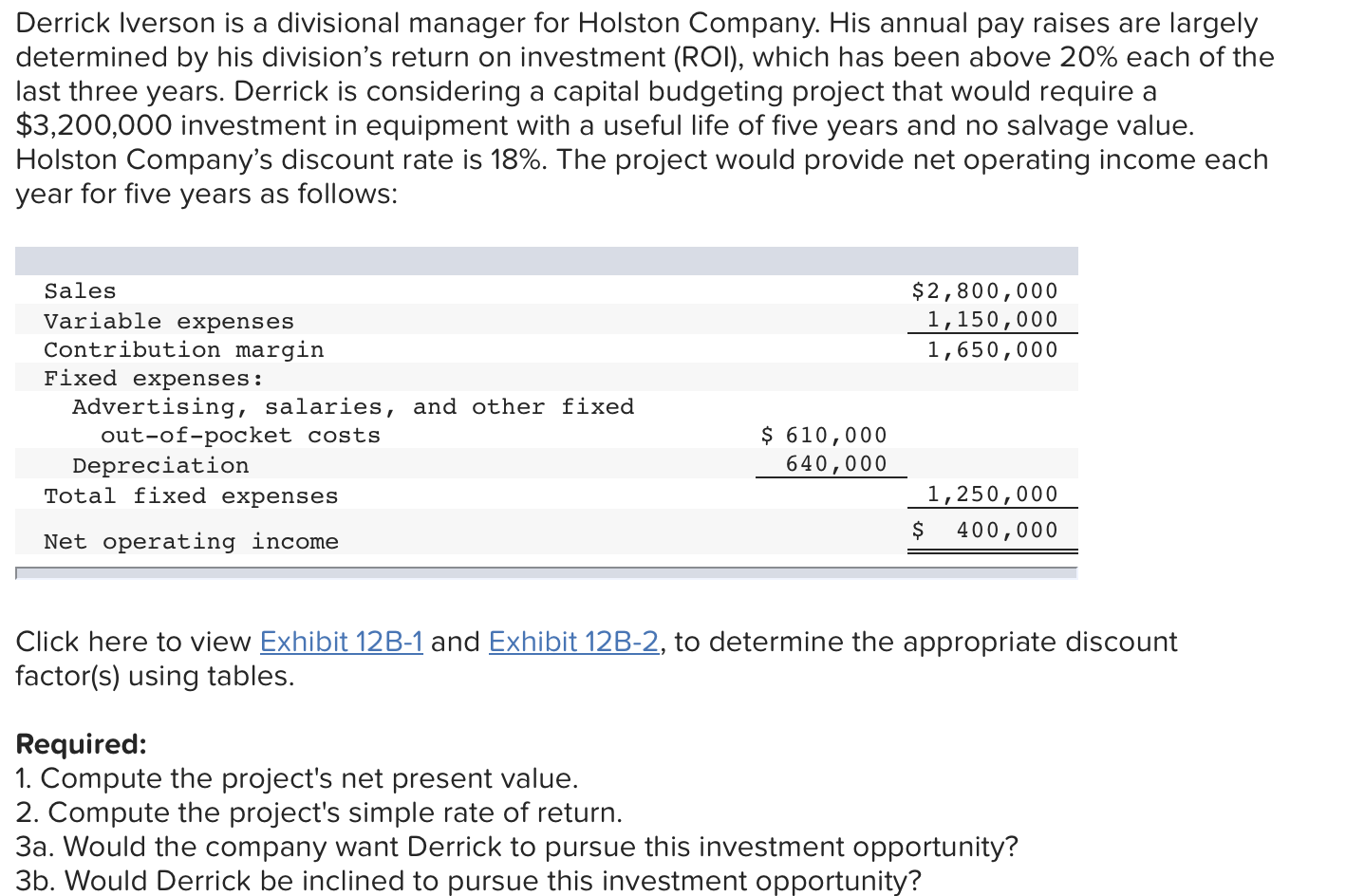

CHAPTER 11 SAMPLE QUESTION 11Required informationThe following information. Would Derrick be inclined to pursue this investment. Derrick is considering a Capital Budgeting project that would require a 3000000 investment in equipment with a useful life of five years and no salvage value.

Managerial ACCT Quiz 20pdf - Hints Hint1 References 49 Award 1000 points Problems Adjust credit for all students Derrick Iverson is a divisional. School University of California Davis. Sales 3400000 Variable expenses 1450000 Contribution margin 1950000 Fixed expenses.

1666 points Complete this question by entering your answers in the tabs below. Would the company want Derrick to pursue this investment opportunity. EXERCISE 8-10 Basic Net Present Value Analysis LO 8-2 Kathy Myers frequently purchases stocks and bonds but she is uncertain how to determine the rate of return that she is earning.

Derrick is considering a capital budgeting project that would require a 4140000 investment in equipment with a useful life of five years and no salvage value. View A_Chp11_TUT from FINANCE 370 at University of Phoenix. However Derrick might be inclined to reject the opportunity because its simple rate of return of 134 is well below his historical return on.

However Derrick might be inclined to reject the opportunity because its simple rate of return of 10 is well below his historical return on. Holston Companys discount rate is 16. The project would provide net Operating Income each year for five years as follows.

Would the company want Derrick to pursue this investment opportunity. O Yes O No 3-b. Managerial ACCT Quiz 20pdf - Hints Hint1 References 49.

EBook Hint Reg 1 Reg 3A Reg 38 Pin 012 should be considered as References Compute the projects simple rate of return. Derrick is considering a capital budgeting project that would require a 4700000 investment in equipment with a useful life of five years and no salvage value. Would Derrick be inclined to pursue this investment opportunity.

The owners of the company would want the CEO to pursue the investment opportunity because its ROI of25 exceeds the companys minimum required rate of return of 15. Compute the projects simple rate of return Simple rate of return 134 The simple from ACCTG 202 at Brigham Young University Idaho. Would the company want derrick to pursue the investment Answered.

The company would want Derrick to pursue the investment opportunity because it has a positive net present value of 52080. Holston Companys discount rate is 19. His annual pay raises are largely determined by his divisions return on investment ROI which has been above 25 each of the last three years.

Derrick is considering a capital budgeting project that would require a 3000000 investment in equipment with a useful life of five years and no salvage value.

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

No comments for "Would the Company Want Derrick to Pursue This Investment Opportunity"

Post a Comment